One Vote. A Cooperative Union

When it comes to financial institutions, we can look the same on the outside. Deposits. Savings. Checking. Loans. You have options, and you can choose the one that's right for you based on your needs and goals at that time. Then you scratch the service and see there is a difference.

At the core of what we do as your credit union are people serving with a purpose. Not just for your financial purpose, but your life's purpose. As a financial cooperative, our democratic principles ensure that each member receives equal consideration for financial services. You have equal ownership, not based on account balances, so your success adds to the credit union's overall success. And, finally, you have an equal voice with the other members through elections and votes at the annual membership meeting. You are our purpose. You are our priority. Not just this day or this year, but for continuing to build our legacy of improving lives for generations to come.

We hope you will join us so your vote can add to our cooperative system. Monday, February 23, at 6pm at Winyah Auditorium in Georgetown. Members* can pre-register Feb. 9-13 at any branch or register with their attendance that night. We will review the past year's financials and operations, discuss any new or existing business, elect new officials, and recognize staff/volunteers. Door prizes will be given to all registered members, and those in attendance will be entered into prize drawings. We look forward to seeing you all there! ~ GKCU

(*Only members in good standing can vote. Accounts must be brought current in order to vote or participate).

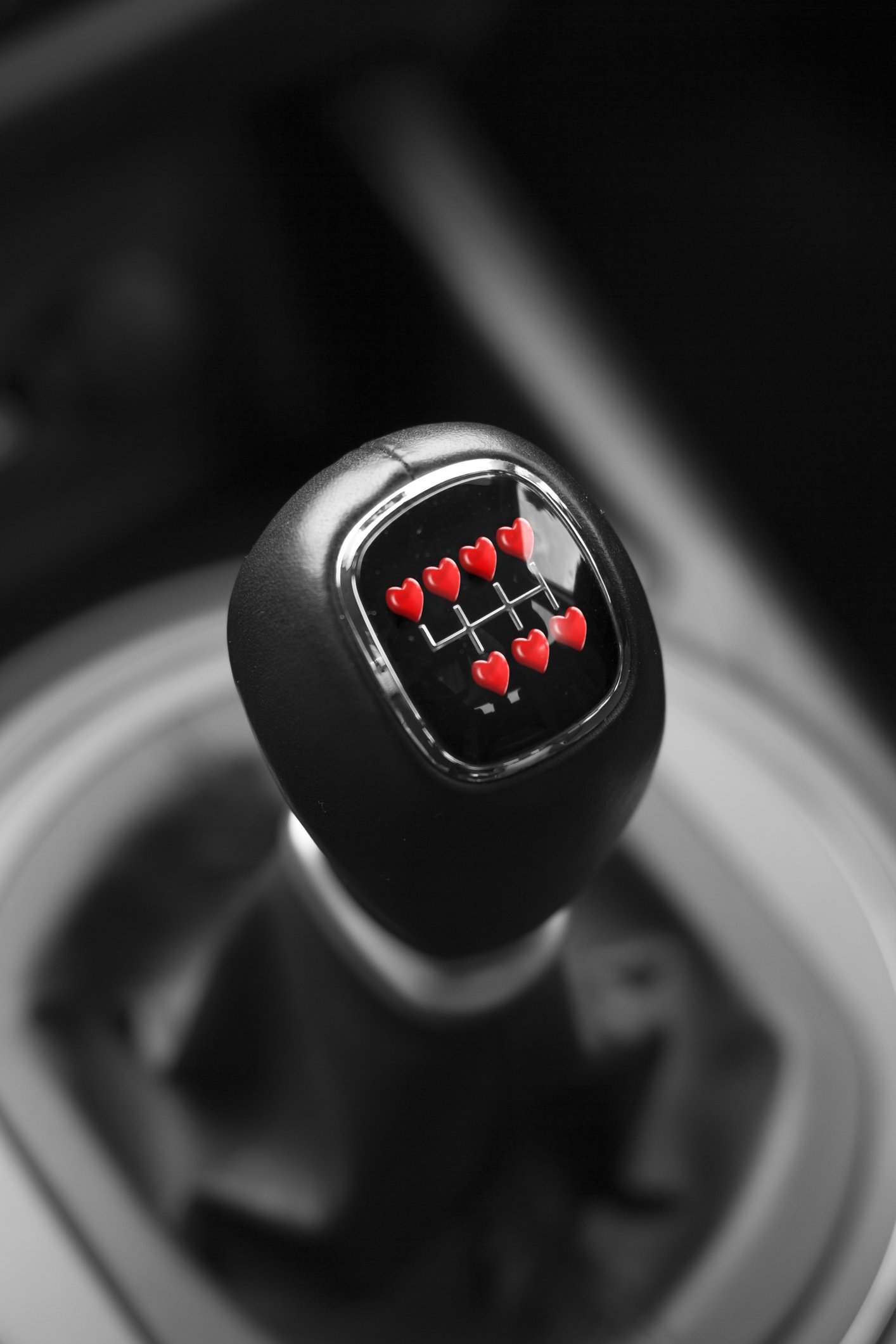

Shifting Love to a New Car

We depend on our cars to get us where we need to go - to work, to school, to the gym, to run errands, to grab something to eat. Over time, however, we actually find ourselves loving this little machine that takes us places.

Parting is such sweet sorrow, but if it's time to break up with your beloved car and find a new love, make sure you do your research to find the best car at the best price.

Research brands and models online. Check out manufacturer websites to see available options, warranties, and recalls. Check to make sure the model you want isn't being phased out or replaced by newer versions, as this can limit factory warranties and replacement parts. GKCU's Online CarCommander Auto Search is a great place to start comparing, shopping, and even applying online.

Choose if you want new or pre-owned models. While pre-owned vehicles may offer lower purchase prices, they often come with higher maintenance costs and may not include factory warranties. To determine your purchase price range, stop by and get pre-approved to help you at decision time.

Finally, factor in all the add-ons that come with car purchases, such as down payments, taxes, titles, insurance, and maintenance. You do not want to hit the brakes on this new relationship just as it gets started.

GKCU is here to help develop long-lasting relationships with great rates and terms, so stop by or apply online.

Love your car but not your monthly payment?

*Consider refinancing your current car loan by moving it to another lender like GKCU.

*Shopping for rates and terms can help you get lower interest rates which translate into lower monthly payments.

*Since refinancing current loan, your borrowed amount will be lower and can help get you a lower interest rate.

*Make payments on-time to avoid late fees.

*If /When you can, make extra payments to help pay down the balance faster.

*Ask about Debt Protection and Extended Warranties to help with maintenance costs.

*Check your credit score via GKCU's free online Credit Sense (in the GKCU2GO online banking) to set goals for improving credit for future purchases

Goodbye is Never Easy

We are never truly prepared to lose someone from our lives. The mix of emotions like grief, exhaustion, and sadness overwhelms us, often leaving us to live in a state between memories and reality. Wondering what we do next and how to move on from here?

One of the toughest aspects of dealing with the passing of a loved one is handling the financial affairs left behind. Knowing where to look to find account information, the documents needed, and the step-by-step process to follow can leave many family members confused and frustrated. If you are the designated trustee or beneficiary, here are some steps to guide you through the initial process:

Initiate probate to appoint an executor, inventory assets, handle creditors, pay taxes, and even notify credit bureaus. Creditors have up to 1 year to file claims. To learn more, visit the Probate Court website.

Identify all open accounts with passwords (if available), outstanding checks, and balances. Review any bills set for auto-pay to stop future payments or set up in your name to pay.

Schedule an appointment with each financial institution to discuss account options. Bring a copy of the death certificate and any other applicable documents such as trustee designation. Most financial institutions have a set time, upon notification of death, to honor outstanding debits, to change the accountholder, or to close the account with funds moved to an estate account or to the beneficiary.

To protect against fraud, financial accounts may be blocked to not allow any transactions after a certain number of days (at GKCU it is 60 days.) This protects the funds from unauthorized transactions.

Losing a loved one is never easy, but starting in the right direction will help you handle financial needs as quickly as possible. GKCU is here to help throughout the process whether for a loved now or for you later on.

Dreaming of Island Time?

Pull up a chair to start saving now.

GKCU Club Accounts

Set Up Auto-Transfers for easy deposits.

Earn interest on savings.

Federally Insured by NCUA

Even in the chillier temperatures, GKCU loves getting out into the community. From volunteering to read books in classrooms, to attending Legislative breakfasts, to talking all things money to elementary school students, GKCU is proud to be building a stronger, better place for us to live in.